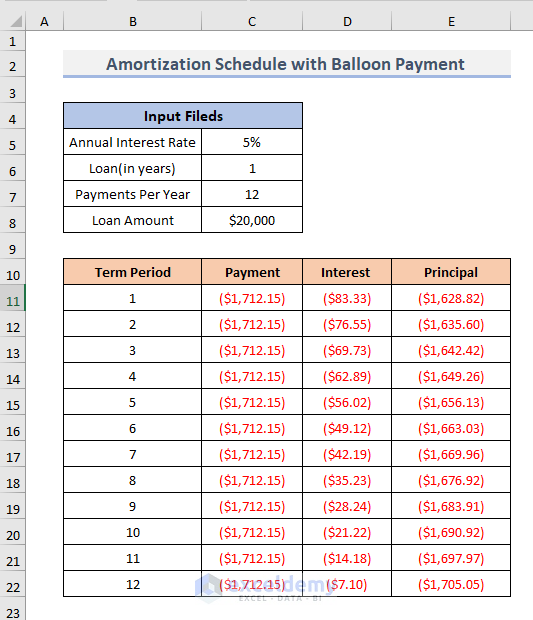

As you reduce the principal balance, less interest is charged per payment. When amortizing a loan, your first loan payment consists mostly of interest. Amortization builds principal and interest into each payment, ensuring you pay both, and structures predictable payments for the borrower. It’s used commonly for mortgages, auto loans, student loans, and personal loans.

A template simplifies what can often be a complex process with many difficult formulas.Īmortization involves breaking a fixed-rate loan into equal monthly payments to pay off by a certain date. Get the template What is an Excel loan amortization schedule template?Īn Excel amortization schedule template - what a mouthful - is a pre-structured document with fillable fields that helps you fill out a loan amortization schedule.

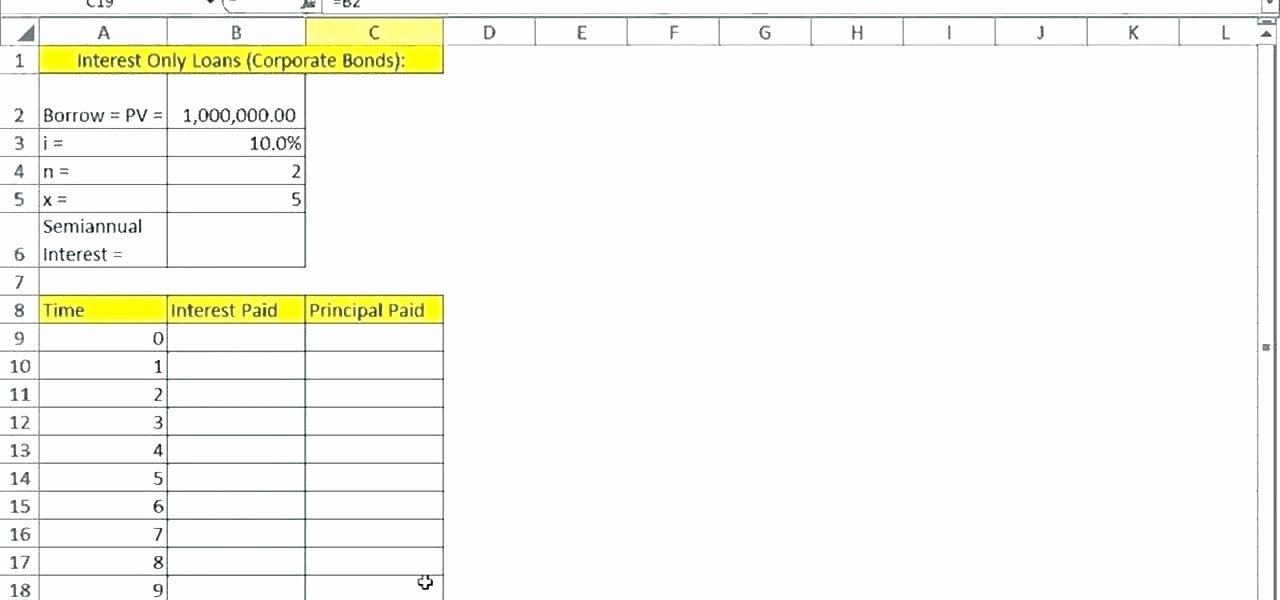

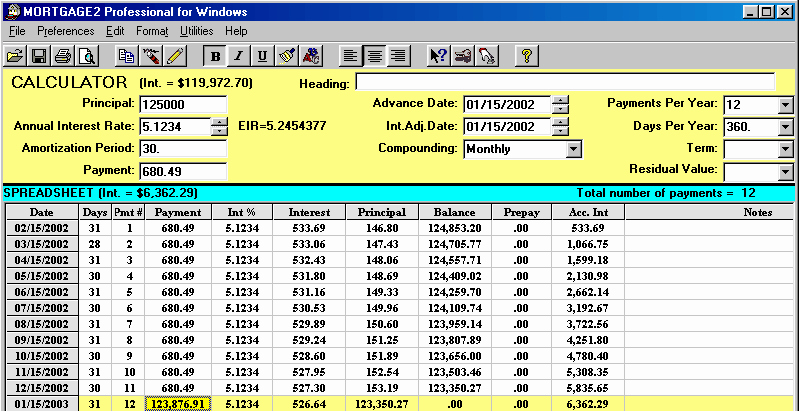

To help make this easier, we’ve created a fully customizable template that you can export into a completed Excel spreadsheet with just a few clicks. Paying loans back involves using an amortization schedule, breaking the loan into equal monthly payments of principal and interest. The table displays the monthly payment, each month's portion of principal and interest, as well as the final balloon payment.Loans help us buy things that are too expensive to pay for with cash in hand, such as homes, cars, and business assets. (Note, 7.05% = 7.05/100 = 0.0705.)Īfter hitting the "Create Table" button, the full amortization table will appear in a separate window which you can easily print. To use the amortization calculator above, Luke enters 70000 for the principal, 120 for the lending term, 240 for the amortization period, and 0.0705 for the interest rate. The lending period is 10 years and the amortization period is 20 years.

Luke takes out a balloon mortgage $70,000 at an annual rate of 7.05%. Principal = $ Lending Period = months Amortization Period = months Interest Rate (Decimal) =

A new window will appear with a printable amortization table showing your monthly payments and balloon payment. Simply enter the principal (amount borrowed), the length of the loan in months (number of years times 12), the length of the amortization period in months, the interest rate as a decimal (percent divided by 100), and then hit the "Create Table" button. Use the tool below to generate a printable amortization schedule for a balloon mortgage. Printable Balloon Mortgage Amortization Table and Calculator

0 kommentar(er)

0 kommentar(er)